Novel ML Trading

By Lachlan Suter, Brayden Richardson, Ford Lascari, Zach Hussin

Introduction

The evolutionary arms race of stock trading continually drives the development of new machine learning methods. What we propose to do, is to take an artificial neural network known as an LSTM (Long Short-Term Memory) and use it in lieu of traditional trading models.

Methods

Stock Selection

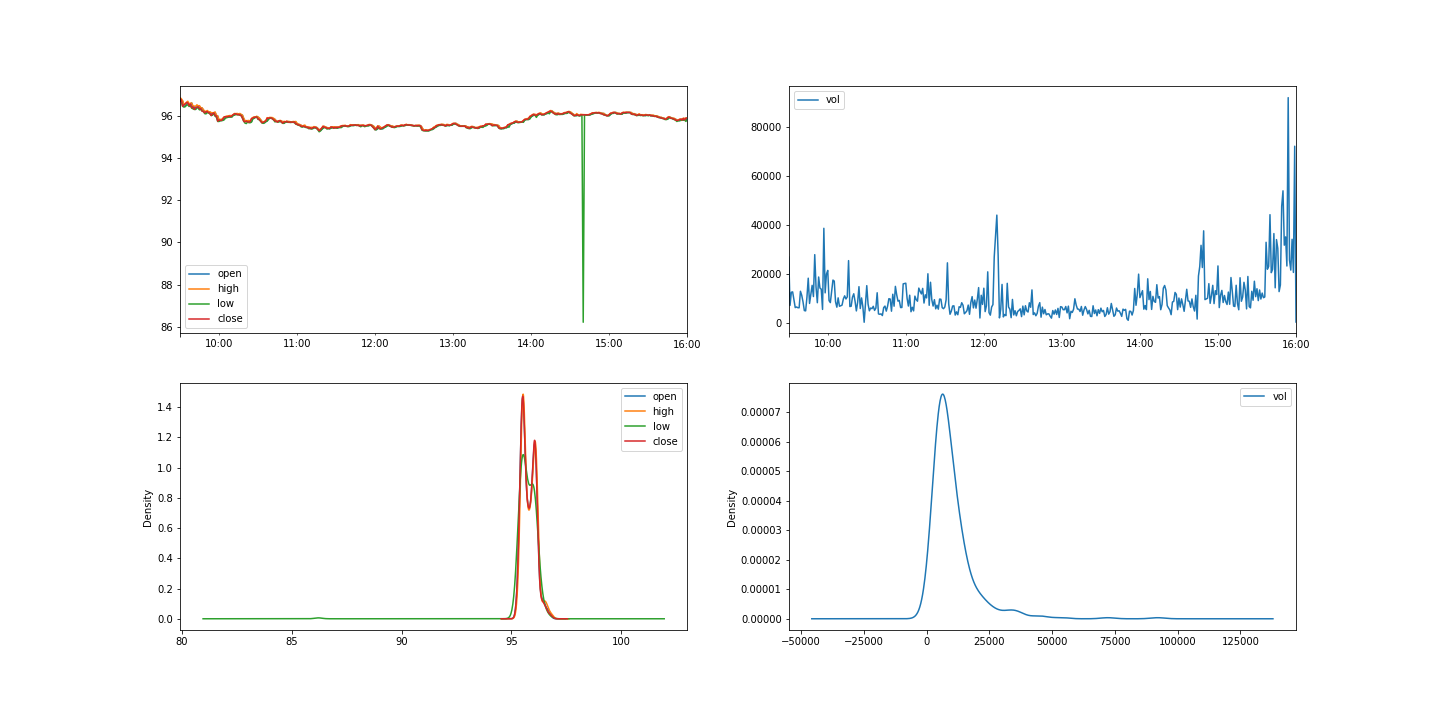

The data chosen were the intraday Trade and Quote prices and volumes of MA (MasterCard) over the days of May 2016 (source: WRDS).

Preprocessing

Discretization

To allow for consistent forecasting, and to eliminate the impact of tiny discrepancies of time as a pure input, the data was binned into discrete buckets.

Bucket Description

The buckets spanned from 9:30 AM to 4:00 PM, every business day. Each bucket was 1 minute long, and contained the opening, closing, high, and low price, as well as volume traded, for the bucket. The width of the buckets was minimized while ensuring every bucket had at least one data point.

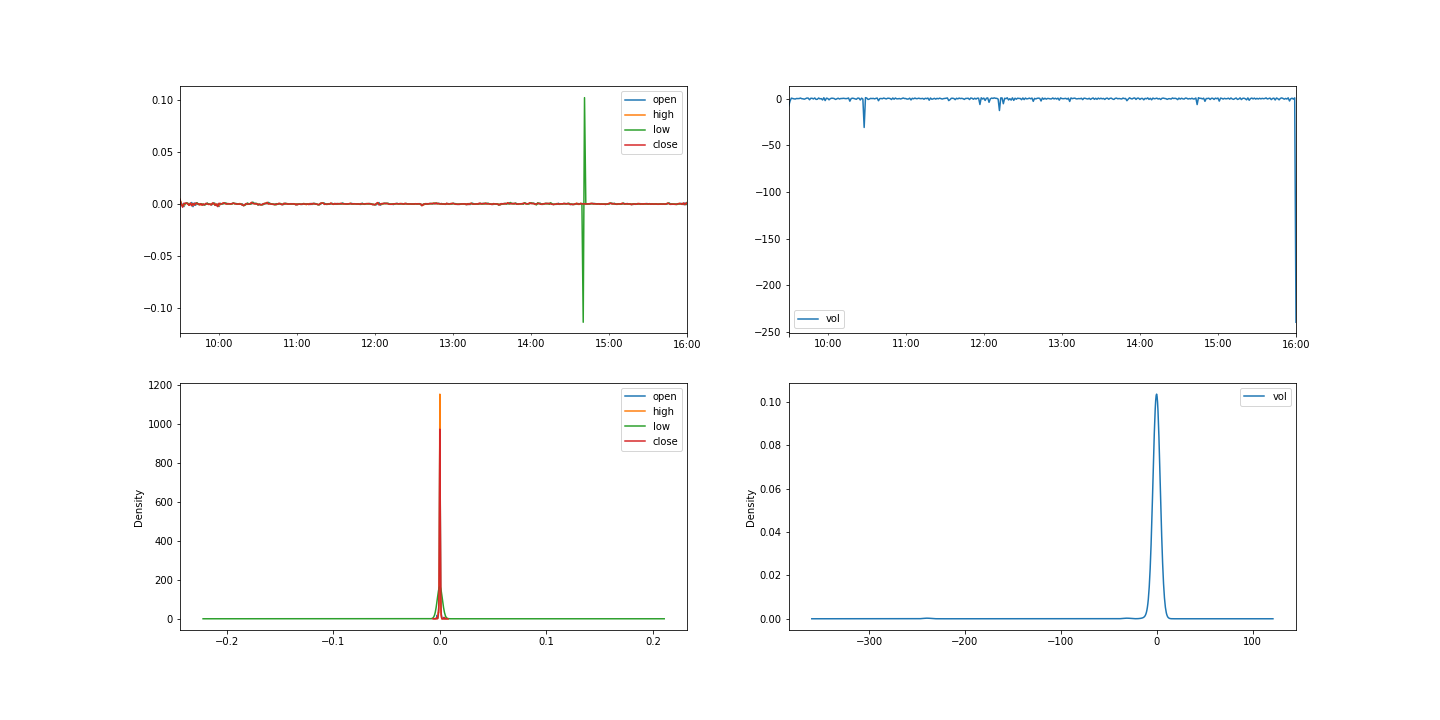

Feature Engineering

This process created a slew of features for models. The data need to be processed again, however. This stems from Stationarity. Stationary data has a constant mean and standard deviation over a given time period. Forecasting non stationary data is unreliable. To create Stationary data, the difference between a bucket’s parameters and the previous bucket’s parameters was calculated. This difference for a given bucket was calculated for all 5 previous buckets to create more features. The difference data was stationary and thus suitable as a set of parameters for forecasting models.

Normalizing

Data was normalized by subtracting the average of feature_n from each feature_n, and dividing the subsequent feature_n by the standard deviation of feature_n. This reduces scaling errors from features that have different units and scales. In this case, the scaling error between price and volume is reduced.

Metrics

Models are successful if they return a higher percent profit over the time frame than comparable methods. To quantify this success, we chose two metrics: average profit per day and average ratio of correct purchases to total purchases per day.

Models & Results

Ridge Regression

Reasoning

We assume that a price at time = n is related to a price at time = n+1, and that the differences in prices likewise reflect a dependent relationship. The parameters will suffer from multicollinearity. To tackle multicollinearity, ridge regression was proposed as a model. Ridge regression is a regression model built to account for multicollinearity. In ridge regression, a constant is added to all diagonal indices of the correlation matrix to improve variance.

Model implementation

In the model used here, the constant to add was found using scikit-learn’s auto setting. All differences in open, close, high, low prices as well as volumes were passed as parameters, in addition to prices. The model was trained to predict the open price at one and two timesteps of 1 min in the future from the current open price.

Bot Implementation

The trading bot took in parameters as listed above. When the model predicted a price increase from the next open price to the subsequent open price, it would purchase one stock. When the model predicted a decrease in a similar fashion, it would sell all the stock. Selling all the stock increases the chance to be fully exited from one’s market position by the end of the day, and encourages the bot not to be forced to sell all the stock at a closing price.

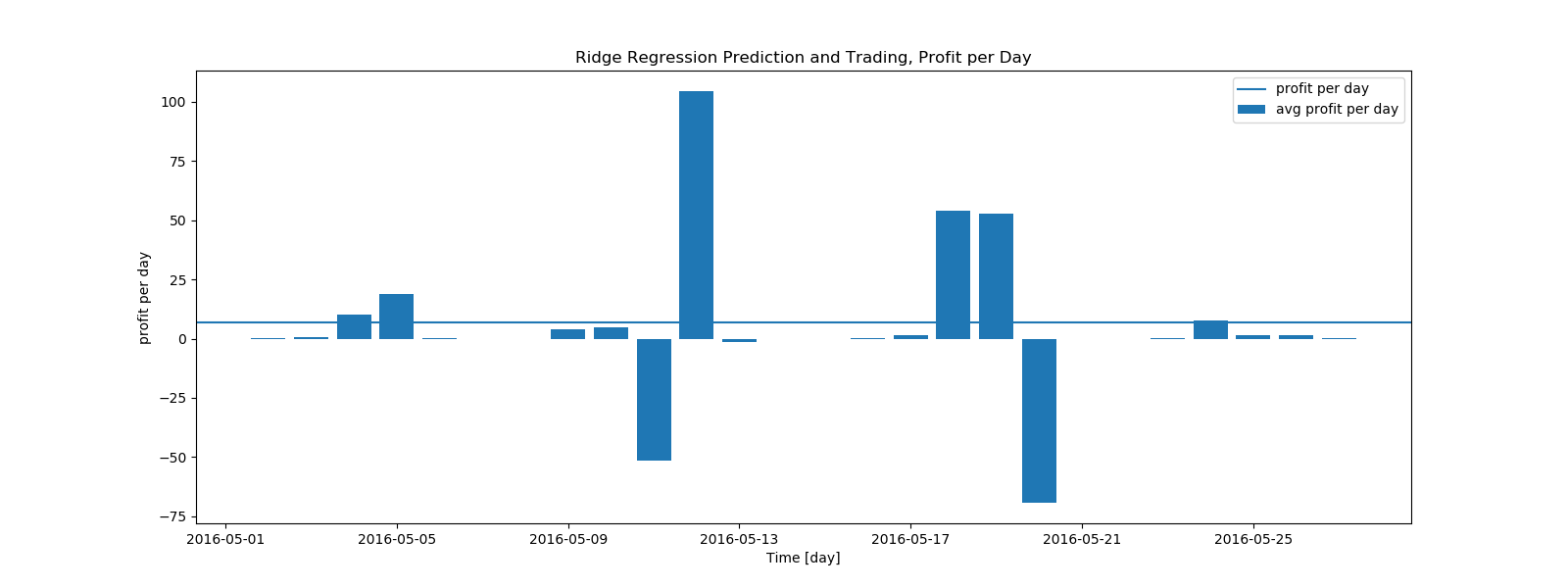

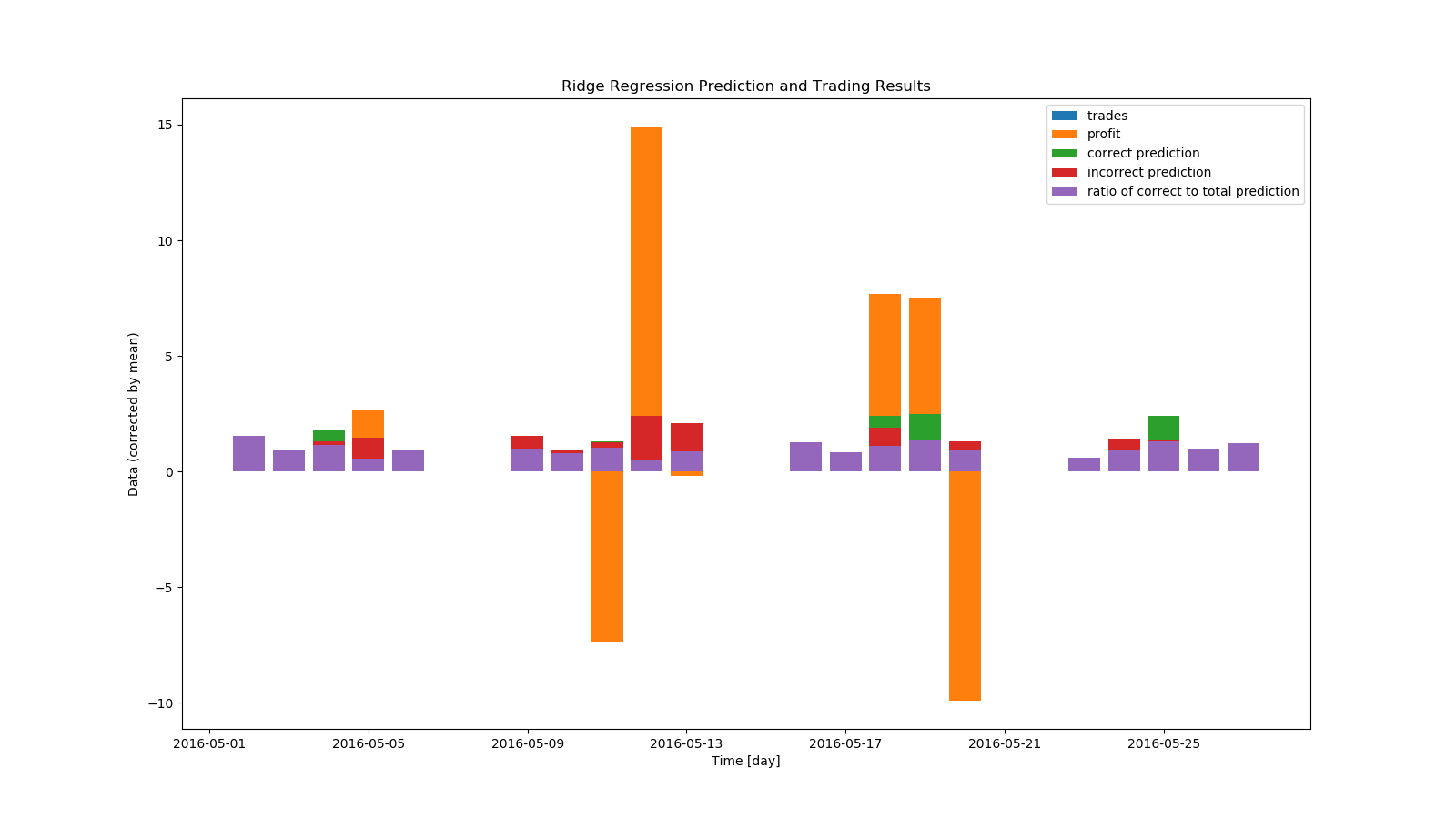

Results

avg profit per day, median and mean

$1.47,

$7.01

avg stocks traded per day, median and mean

291,

259

avg correct predictions per day, median and mean

95,

124

avg incorrect predictions per day, median and mean

161,

134

avg ratio of correct to total predictions per day, median and mean

47 %,

48 %

The ridge regression model and bot produced $7.01 dollars every day on average, with no cap on how much money is invested at any given time. From the graphs we can see most of the change in profit came from two days. This implies that the model is not consistent. The model also correctly predicted prices only 48% of the time. Let’s see if we can do better - both more consistent, and more correct predictions.

LSTM

Reasoning

LSTM neural networks are a form of recurrent neural network. Normal RNN’s suffer from what is called short-term memory, where if a sequence is very long, information can be lost when carrying it from previous steps. Layers that get a small gradient update stop learning, usually earlier layers, RNN’s can forget what it seen in longer sequences, thus having a short-term memory. LSTM’s fix short-term memory by having internal mechanisms called gates that regulate the flow of information. These gates can learn which data in a sequence is important to keep or throw away. Thus, it can pass relevant information down the long chain of sequences to make predictions. A times series problem such as stock trading can occur over a very long segment of time and need a very long neural network to predict, so a LSTM is a very good approach to this problem.

Model Implementation

LSTM will account for the relative importance of previous differences in prices. Each LSTM node was given 7 price differences as parameters, from a span of 7 bin’s price difference between each other. It was trained to predict price difference one timestep in the future. There were 256 hidden layers. Epochs ranged from 30 to 120 over various trials. The model was trained on a majority of the price data at the beginning of a day, and predicted the remaining price data during the rest of the day.

Bot implementation

The trading bot took in parameters as listed above. When the model predicted a price difference one timestep in the future, it would buy a stock at the current price and sell at the next open price. Exiting positions immediately after buying again encourages the bot to be fully exited from all positions by the end of the day.

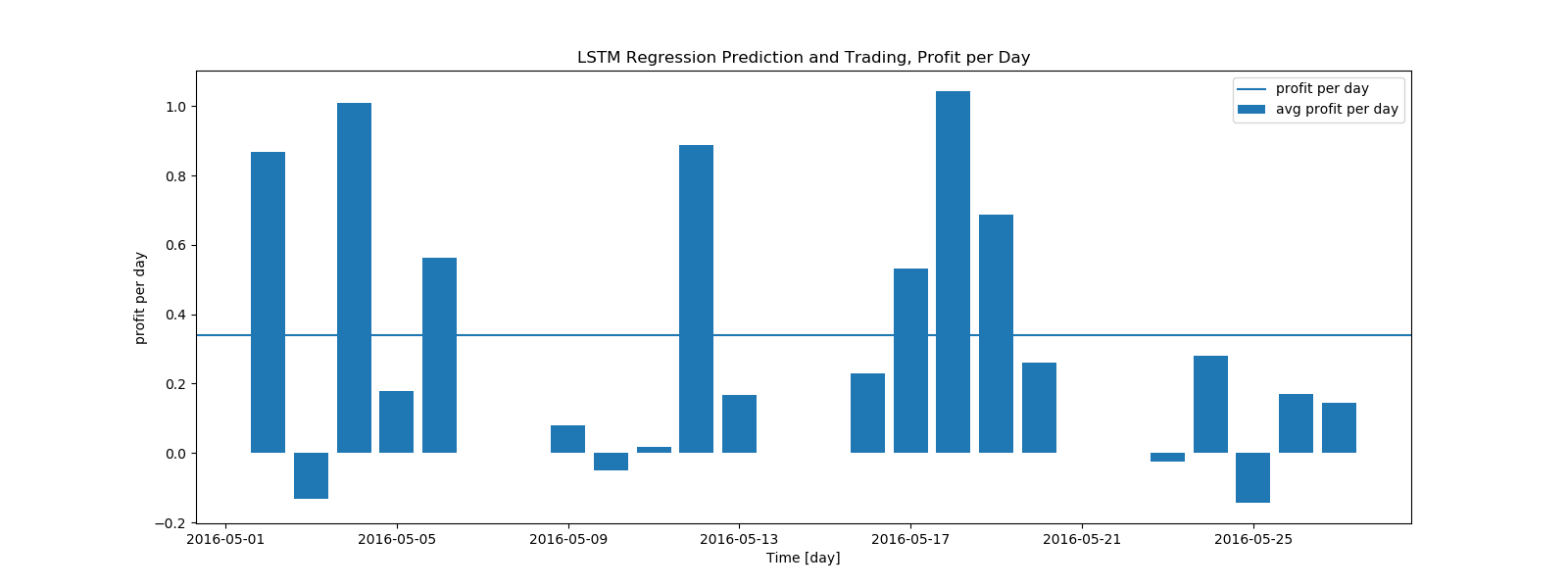

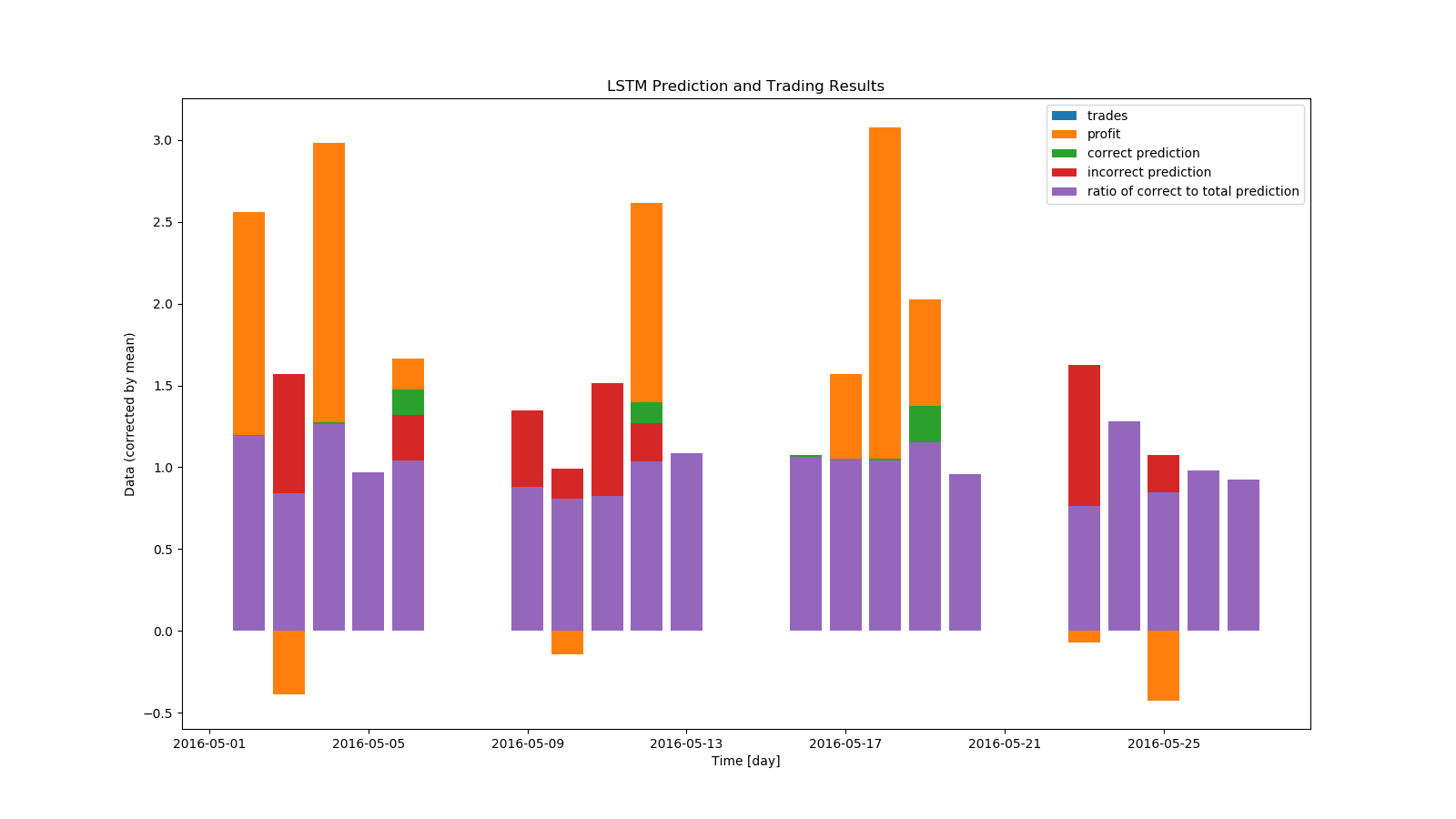

Results

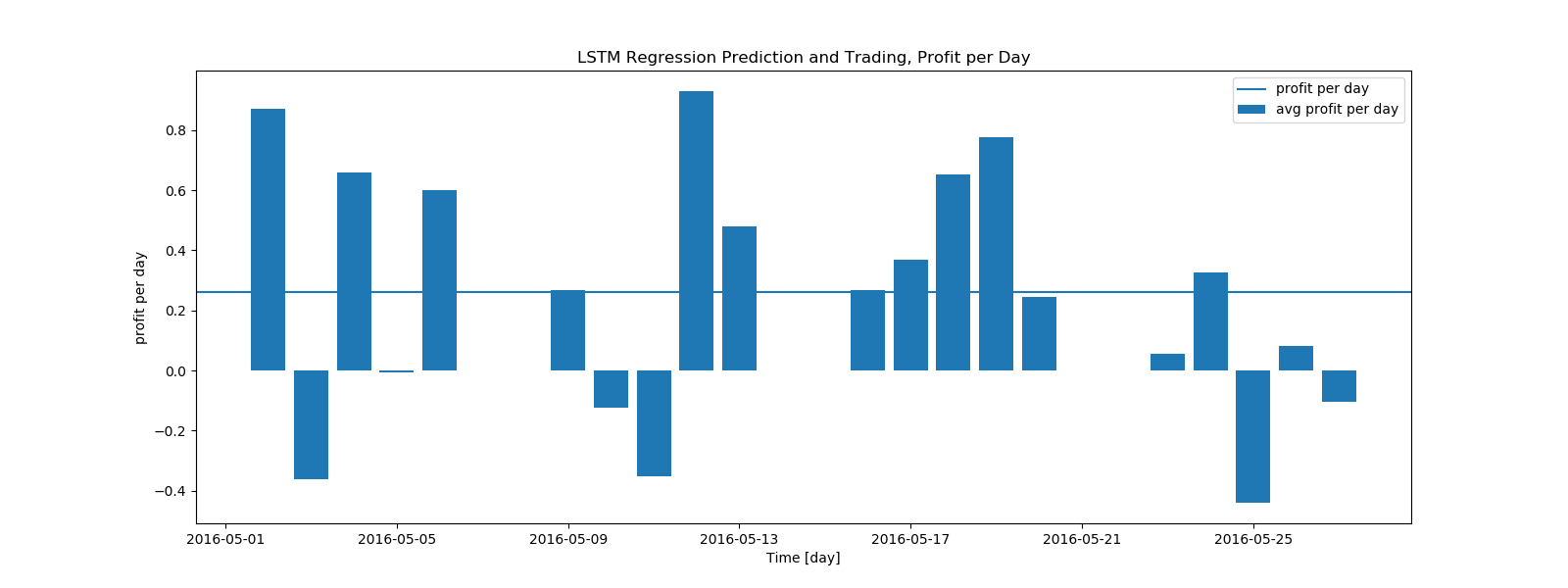

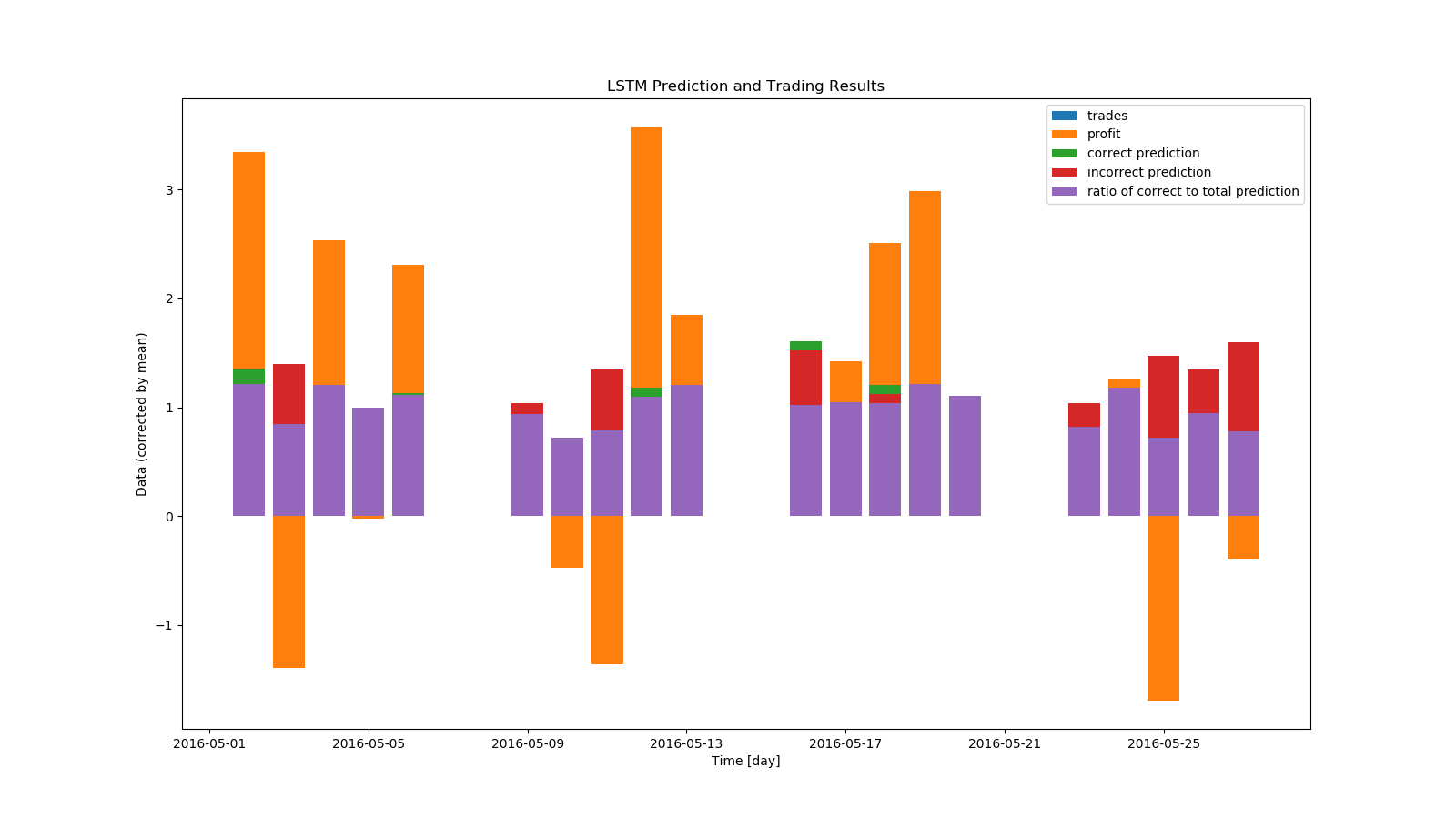

Epochs - 50

avg stocks traded per day, median and mean

79.5,

79.15

avg profit per day, median and mean

$0.27,

$0.26

avg correct predictions per day, median and mean

40.5,

39.8

avg incorrect predictions per day, median and mean

37.0,

39.4

avg ratio of correct to total predictions per day, median and mean

51.8%,

50.4%

Even for 50 epochs, we see an immediate improvement in the ratio of correct predictions and consistency in profit. We also know that the bot has never leveraged more than the price of one stock, and thus is less risky compared to the regression bot.

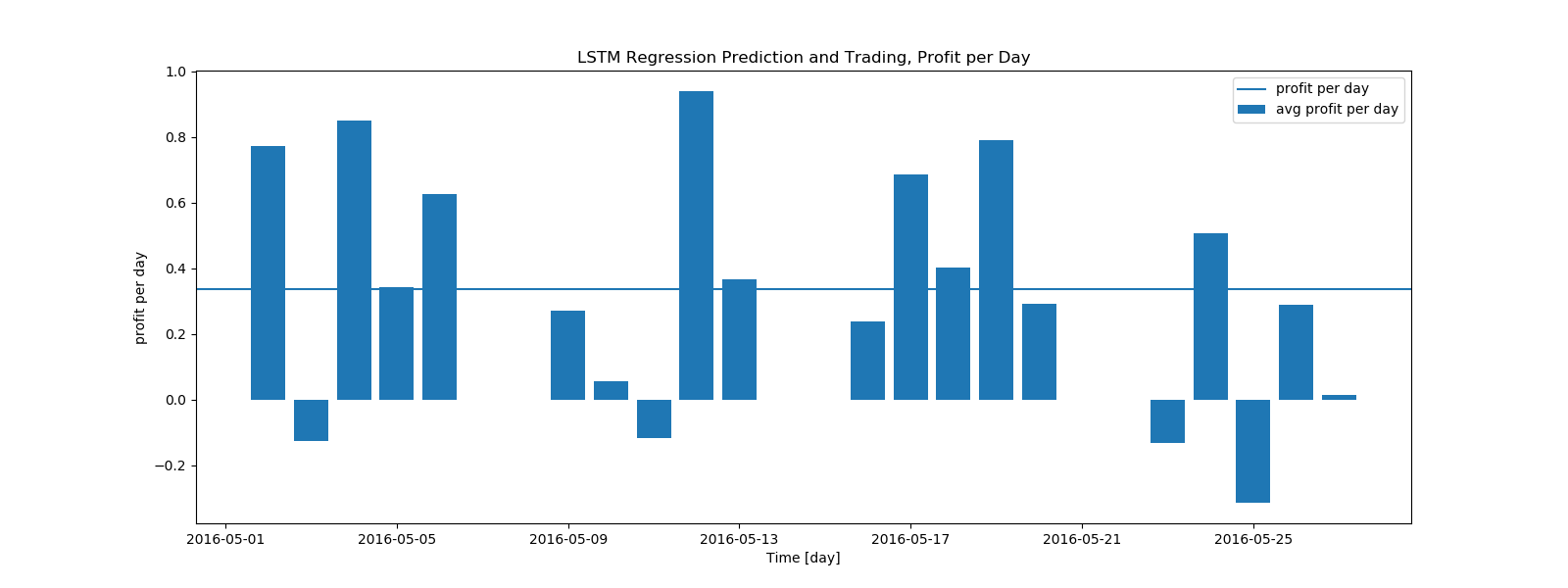

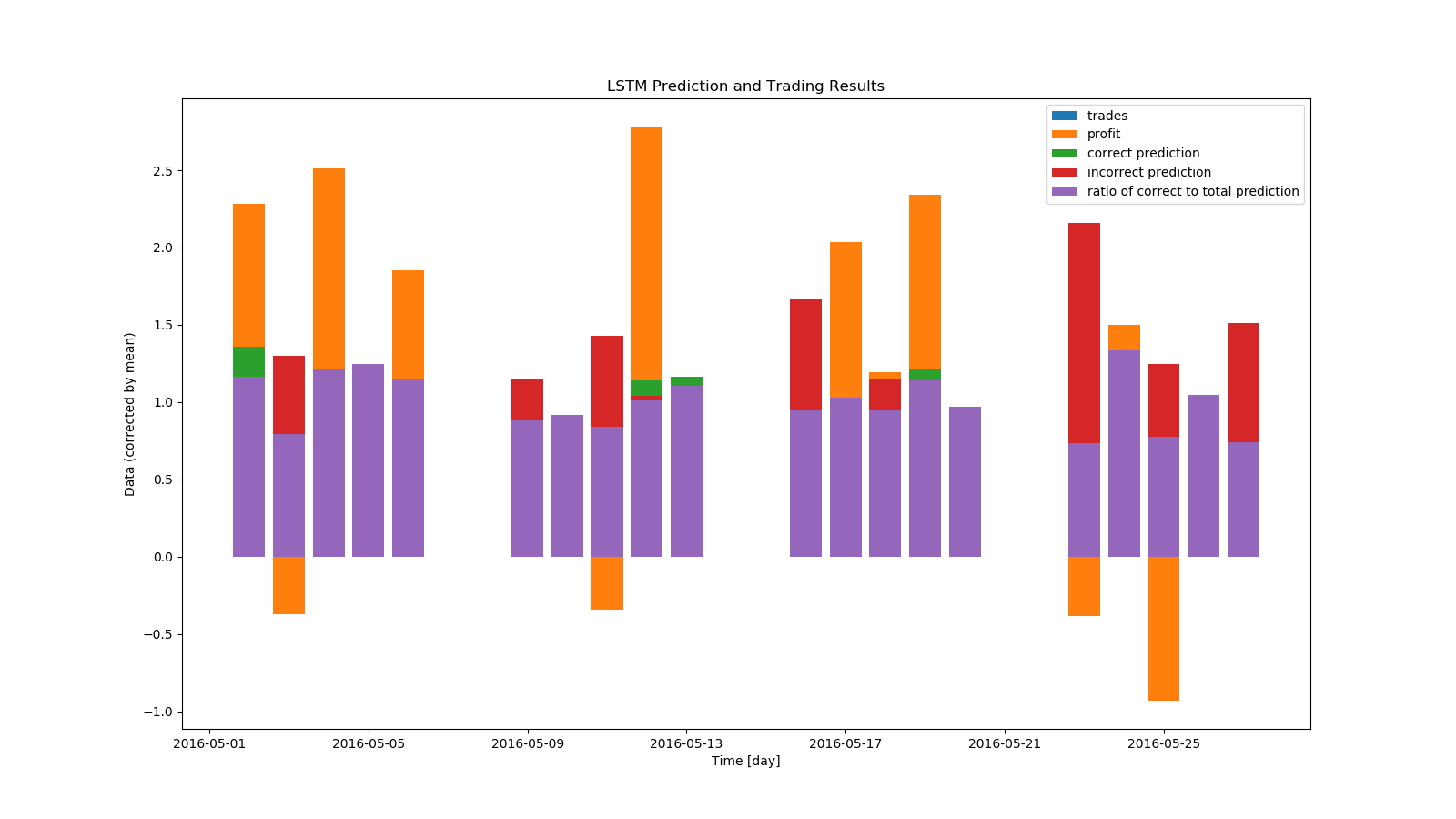

Epochs - 80

avg stocks traded per day, median and mean

82.0,

79.7

avg profit per day, median and mean

$0.317,

$0.338

avg correct predictions per day, median and mean

40.5,

41.25

avg incorrect predictions per day, median and mean

33.5,

38.45

avg ratio of correct to total predictions per day, median and mean

53.0%,

53.5%

We see an increase in the profit and ratio of correct to total predictions with an increase in epochs.

Epochs - 120

avg stocks traded per day, median and mean

76.0,

76.3\

avg profit per day, median and mean

$0.204,

$0.339

avg correct predictions per day, median and mean

42.0,

40.0

avg incorrect predictions per day, median and mean

33.5,

36.3

avg ratio of correct to total predictions per day, median and mean

53.5%,

53.1%

Increasing the epochs further sees diminishing returns on profit and correctness.

Conclusion and Furtherwork

Analyzing time series data sets often asks for more complicated modelling implementations. Traditional regression techniques suffer from multi-colinearity, and even novel regressive techniques like ridge regression suffer from non-independence of timeseries data. Novel neural net techniques, such as LSTM, can be shown to be comparatively better predictors of complex time series data. As seen in the data above, LSTM models tend to produce similar results for predicting stock prices for a given day across all epochs. A future avenue of work could be deriving the hidden factors that hinder a LSTM model on a given day.

Sources

https://wrds-www.wharton.upenn.edu/pages/about/data-vendors/nyse-trade-and-quote-taq/

https://scikit-learn.org/stable/

http://cs229.stanford.edu/proj2016spr/report/049.pdf

lhttps://towardsdatascience.com/stationarity-in-time-series-analysis-90c94f27322ink

https://towardsdatascience.com/ridge-regression-for-better-usage-2f19b3a202db

https://ncss-wpengine.netdna-ssl.com/wp-content/themes/ncss/pdf/Procedures/NCSS/Ridge_Regression.pdf

http://colah.github.io/posts/2015-08-Understanding-LSTMs/